New Child Care Package

What changes in the new Child Care package?

The Australian Government has changed the Child Care Benefit (CCB) and Child Care Rebate (CCR) and implemented a new child care package called the Child Care Subsidy (CCS) which is effective from 2 July 2018.

- The previous system of two payments is replaced with a single, means and activity tested payment;

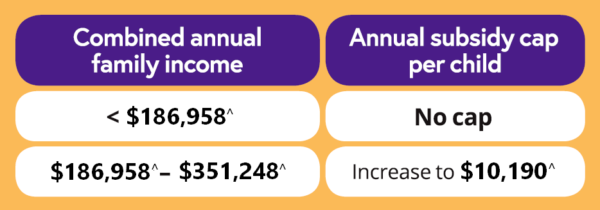

- The annual subsidy cap has been abolished entirely for families with a combined annual income less than $186,958^ whilst for families with a combined annual income of between $186,958^ and $351,248^ the cap will be increased from the current cap of $7,613 to $10,190 per child per year;

- To be eligible families will need to earn less than $351,248^ in combined income and parents must work, study or volunteer at least 8 hours a fortnight;

- The new payment is paid directly to service providers and passed on to families as a fee reduction;

The subsidy is calculated on a fortnightly basis but paid to the service provider weekly. This means that your fee reduction may be more in week 1 than in week 2 of each fortnight; - An amount equal to 10 percent of your CCS entitlement will be withheld by the Government and returned to you as a lump sum following reconciliation and lodgement of your tax return at the end of each financial year unless you have been paid too much CCS in which case you may have a debt to repay.

You can obtain an estimate of the amount of the subsidy you may receive under the new CCS system by following the Payment and Service Finder link on https://www.humanservices.gov.au/individuals/families.

Transitioning to the new Child Care package

Transitioning to the new Child Care Subsidy is not an automatic roll over from the current CCB and CCR. You must provide new information to both the Government and to us as your child care service provider. The details of your child’s / children’s current enrolment arrangements with us must also be confirmed.

If you are currently receiving CCB and CCR payments you should have received a letter from Centrelink advising what you are required to do to transition to CCS.

Key steps are

Sign in to your myGov account. If you don’t have one you will need to create a myGov account;

Link myGov to Centrelink. You can do this under Services;

Select Centrelink and complete the Child Care Subsidy Assessment.

This Fact Sheet provided by the Department of Education and Training should be reviewed to ensure you are on track to successfully transition on 2 July 2018.

Key features of the new Child Care package

3 things will determine your family’s level of Child Care Subsidy

1. Combined Family Income

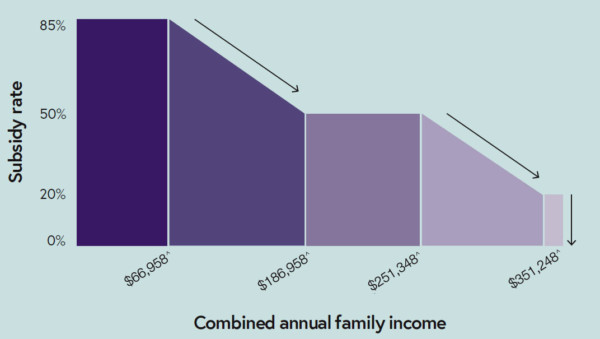

A family’s income will determine the percentage of subsidy they are eligible for.

2. Activity Level of Parents

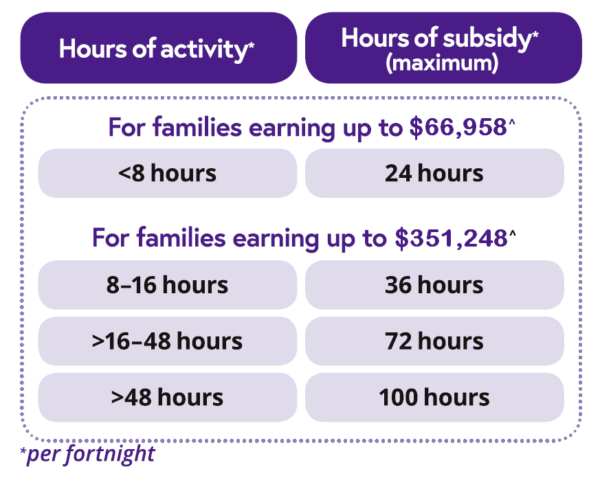

The number of hours of subsidised care families can access will be determined by an activity test. The higher the level of activity, the more hours of subsidised care families can access, up to a maximum of 100 hours per fortnight.

RECOGNISED ACTIVITIES

- paid work – including leave, such as maternity leave;

- study and training;

- unpaid work in family business;

- looking for work;

- volunteering;

- self-employment; and

- other activities on a case-by-case basis.

There will be exemptions for individuals who cannot meet the activity test requirements.

HOURS OF ACTIVITY

The parent or guardian with the lowest hours of activity per fortnight will determine the hours of subsidised care. The hours of subsidy are per child.

For families who do not meet the activity test, there will be an exemption to ensure their preschool aged child can attend a preschool program in a centre-based care service. The exemption will be for the period of the preschool program.

3. Type of Child Care Service

It will be calculated by the hour using these hourly rate caps:

Centre-based care – $11.55^ per hour

Family day care – $10.70^ per hour

Outside school hours care – $10.10^ per hour.